Renters Insurance in and around Baton Rouge

Looking for renters insurance in Baton Rouge?

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

Protecting What You Own In Your Rental Home

Your rented space is home. Since that is where you rest and spend time with your loved ones, it can be advantageous to make sure you have renters insurance, even if your landlord doesn’t require it. Even for stuff like your lamps, books, pots and pans, etc., choosing the right coverage can help protect your belongings.

Looking for renters insurance in Baton Rouge?

Renters insurance can help protect your belongings

There's No Place Like Home

Renters often underestimate the cost of refurnishing a damaged property. Just because you are renting a townhome or home, you still own plenty of property and personal items—such as a a piece of family jewelry, smartphone, coffee maker, and more. All of these have value, which would be a real loss if damaged or destroyed. That's why you need renters insurance from State Farm. Why choose renters insurance from Reiter Marshall? You need an agent who wants to help you examine your needs and evaluate your risks. With competence and wisdom, Reiter Marshall stands ready to help you insure your precious valuables.

Don’t let fears about protecting your personal belongings stress you out! Visit State Farm Agent Reiter Marshall today, and see how you can benefit from State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Reiter at (225) 930-4881 or visit our FAQ page.

Simple Insights®

Moving? Don't forget to make insurance changes, too

Moving? Don't forget to make insurance changes, too

Before you move, talk with your agent about move insurance and moving your current policies. Read why transferring insurance is so important.

Compare different types of mortgages

Compare different types of mortgages

Knowing the different types of mortgages can be confusing. Learn the different mortgage types and determine what may work best for you.

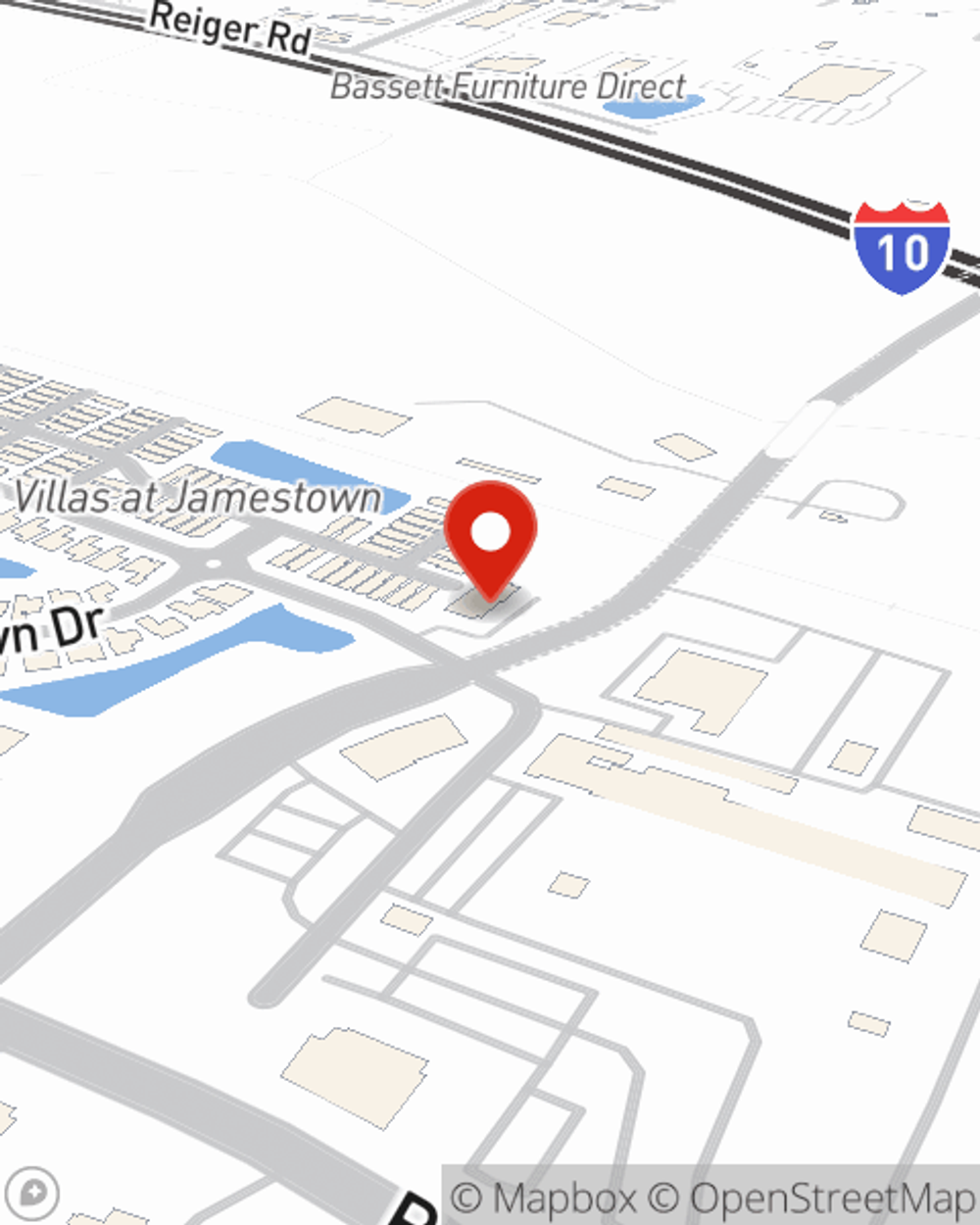

Reiter Marshall

State Farm® Insurance AgentSimple Insights®

Moving? Don't forget to make insurance changes, too

Moving? Don't forget to make insurance changes, too

Before you move, talk with your agent about move insurance and moving your current policies. Read why transferring insurance is so important.

Compare different types of mortgages

Compare different types of mortgages

Knowing the different types of mortgages can be confusing. Learn the different mortgage types and determine what may work best for you.